south dakota sales tax license

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. The sales tax license is obtained through the South Dakota Department of Revenue as a part of filing for the South Dakota Tax Application.

Sales Use Tax South Dakota Department Of Revenue

Businesses performing sales taxable services in South Dakota are required to have a sales tax license.

. Locate your SIC code by selecting the option that best describes your business or. Ad Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one.

Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. Fill out one form pick the states to register in and well do all the heavy lifting. Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form.

Apply For Your South Dakota Sales Tax License. File Pay Taxes. You must obtain a sales tax license if your business has.

South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you. Vehicle Registration Plates.

Several examples of of items that exempt from South. Ad Fill out a simple online application now and receive yours in under 5 days. 31 rows The state sales tax rate in South Dakota is 4500.

This license will furnish your business with a unique sales tax. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. Ad Avalara can help you automate the sales tax registration process.

With a valid South. State Sales Tax License information registration support. Use South Dakota Department of Revenue online services for fast easy and secure completion of DOR transactions.

Municipal Sales Tax and Use Tax Construction services and realty improvements. With local taxes the total sales tax rate is between 4500 and 7500. This application allows for the renewal of the following alcohol and lottery licenses.

State Sales Tax License information registration support. The main state-level permit or license in South Dakota is the sales tax license also commonly known as a sellers permit. South Dakota has recent rate changes Thu.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Complete in Just 3 Steps. Its free to apply for a sales tax permit but other South Dakota business registration fees may apply.

SIC Code Reference Page. In addition to registering for a sales tax. If you have any questions regarding the lottery please contact South Dakota.

The purpose of a Tax Fact is to provide general guidelines on how tax applies to each business activity below. How long does it take to receive your South Dakota sales tax. Ad New State Sales Tax Registration.

If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference. Type in a SIC Code or keyword and press the Search button. Ad New State Sales Tax Registration.

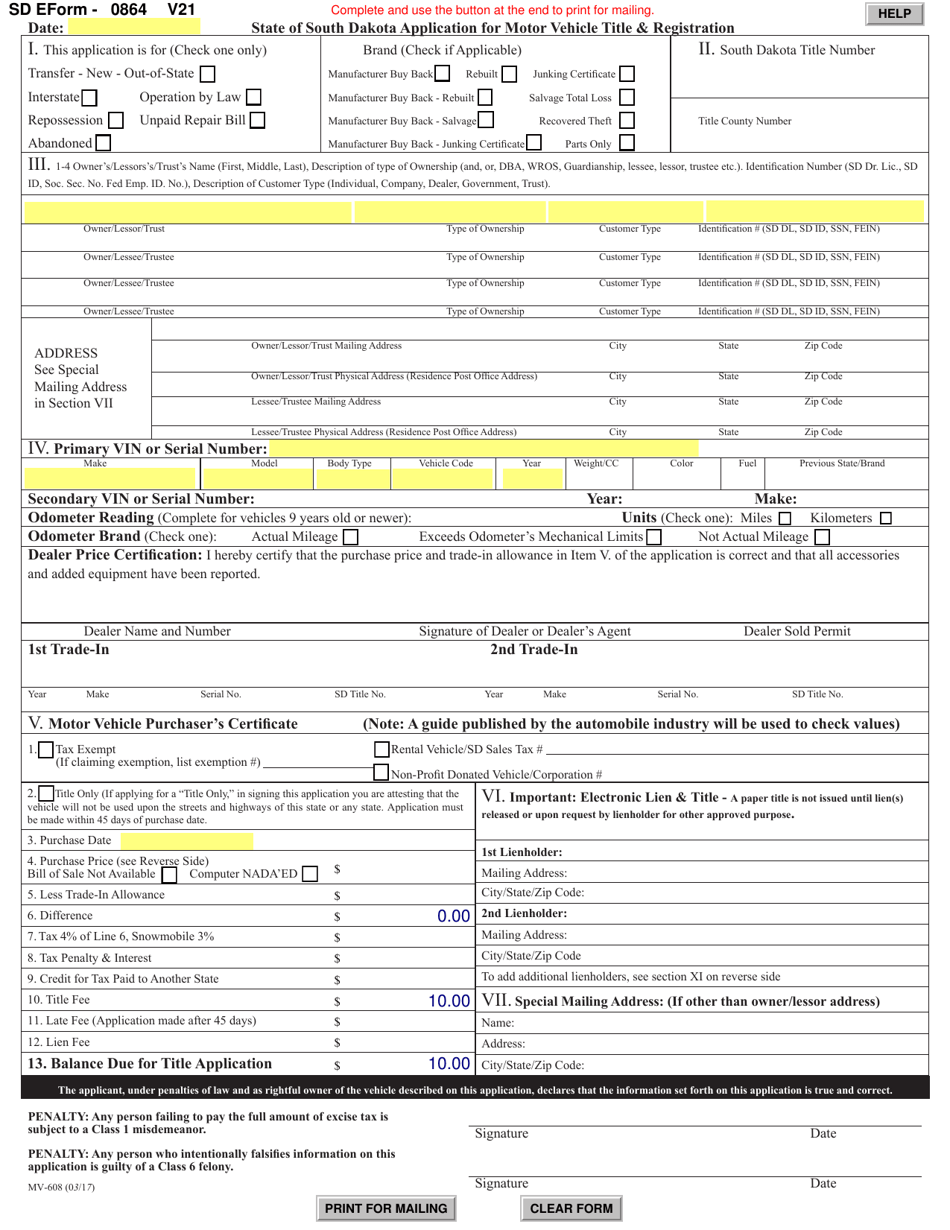

Sd Form 0864 Mv 608 Download Fillable Pdf Or Fill Online Application For Motor Vehicle Title Amp Registration 2017 Templateroller

Trakhees Sars Exam Questions Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

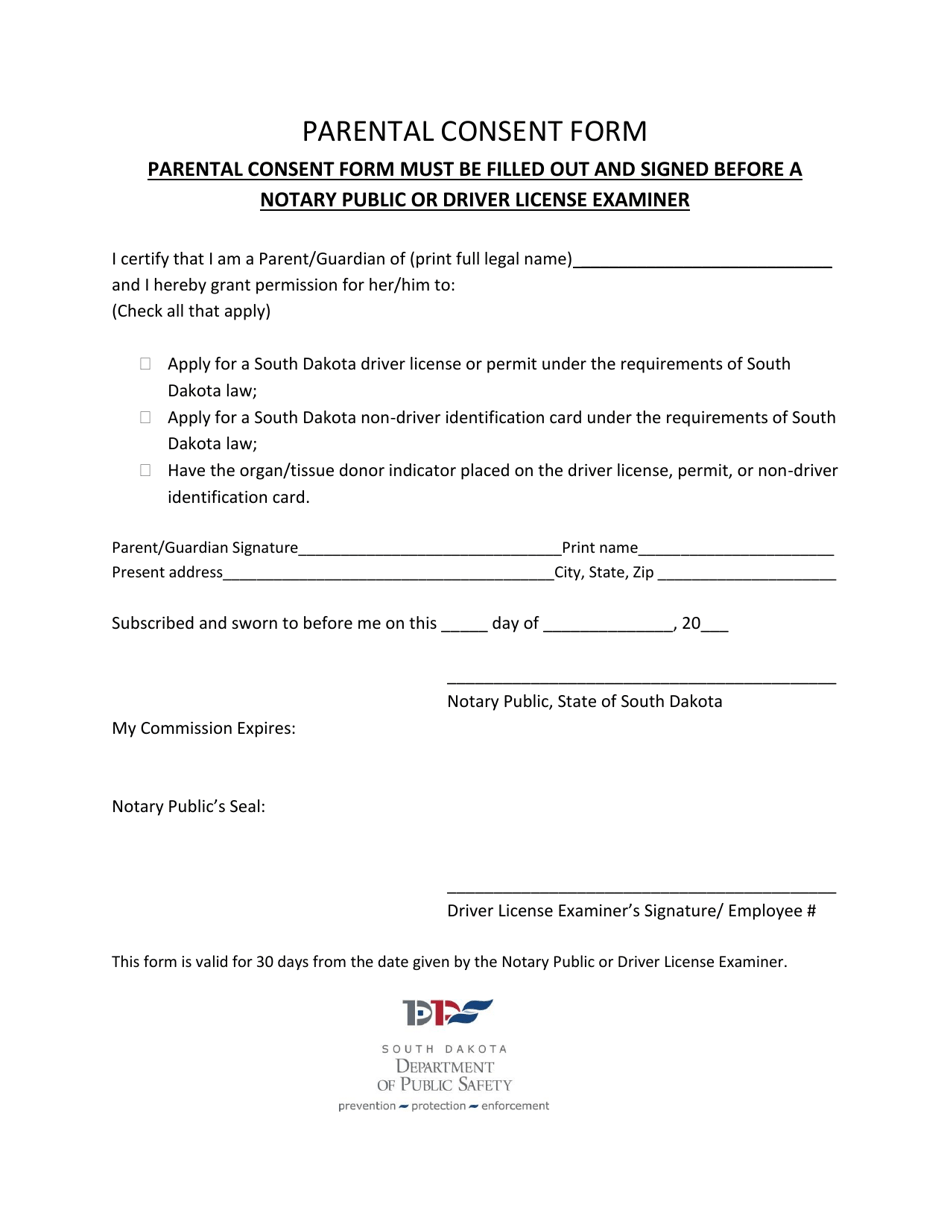

South Dakota Parental Consent Form Download Printable Pdf Templateroller

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax Handbook 2022

How To Register For A Sales Tax Permit In North Dakota Taxjar

South Dakota Sales Tax Small Business Guide Truic

The South Dakota Contractor License Guide To Rules Requirements

Sales Use Tax South Dakota Department Of Revenue

How To Get A Certificate Of Exemption In South Dakota Startingyourbusiness Com

Sales Tax Guide For Online Courses